Scaling textile recycling in Europe

- turning

waste into value

By: McKinsey Apparel, Fashion & Luxury Group

Published: 2022

Access full report here.

Executive Summary

Today, more than 15 kilograms of textile waste is generated per person every year in Europe. The largest source of textile waste is discarded clothes and home textiles from consumers – accounting for around 85 percent of the total waste. The generation of textile waste is problematic as incineration and landfills – both inside and outside Europe – are its primary end destinations. This has several negative consequences for people and the environment. But a significant transformation lies ahead that could create a large and sustainable new industry that turns waste into value.

There are multiple ways to address the waste problem, including the reduction of overproduction and overconsumption, the extension of product lifetime, and designing products for increased circularity. One of the most sustainable and scalable levers available is fiber-to-fiber recycling—turning textile waste into new fibers that are then used to create new clothes or other textile products. This space is characterized by fast-paced innovation and a race toward scale. Some technologies, like mechanical recycling of pure cotton, are already established. Other technologies, like chemical recycling of polyester, have been subject to intense R&D and are on the brink of commercialization. Once fully mature, our estimates indicate that 70 percent of textile waste could be fiber-to-fiber recycled. The remaining 30 percent would require open-loop recycling or other solutions like producing syngas through thermo-chemical recycling.

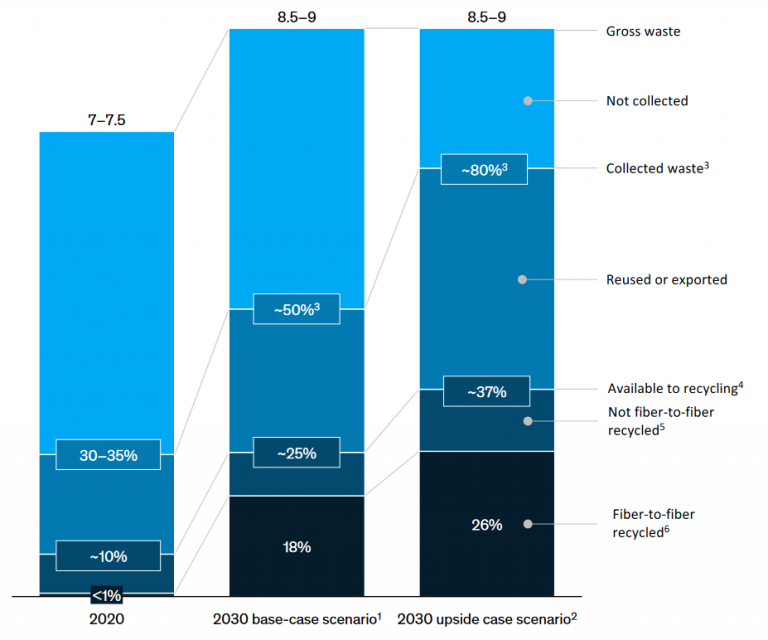

However, today less than 1 percent of textile waste is fiber-to-fiber recycled due to several barriers to scale that need to be overcome. Collection, sorting, and pre-processing limit the amount of textile waste made available to fiber-to-fiber recycling. Collection rates are currently 30 to 35 percent on average, and a large share of the unsorted gross waste is exported outside Europe. Furthermore, most fiber-to-fiber recycling technologies have strict input requirements for fiber composition and purity – or example, elastane is problematic for several of these technologies. Consequently, textile waste needs to be scanned and sorted according to the relevant input requirements. As another example, jeans must have their zippers and buttons removed; a problem that needs to be solved by pre-processing. Advanced, accurate, and automated fiber sorting and pre-processing are not yet developed. Finally, to reach their full potential, the fiber-to-fiber recycling technologies must further expand their ability to handle fiber blends, lower their costs, and improve their output quality – these bottlenecks prevent the circular textile economy from scaling. Our analysis indicates that by overcoming these barriers, fiber-to-fiber recycling could reach 18 to 26 percent of gross textile waste in 2030, as illustrated in Exhibit 1.

Exhibit 1

Fiber-to-fiber recycling could reach 18–26 percent of gross textile waste in 2030.

ESTIMATE AS OF JUNE 2022

EU-27 and Switzerland textile waste volume, millions ton

1. The base-case scenario refers to a situation where 50 percent of EU-27 and Switzerland’s post-consumer household textile waste is collected, up from today’s 30 to 35 percent.

2. The 2030 upside case refers to a situation where 80 percent of EU-27 and Switzerland’s post-consumer household textile waste is collected.

3. Refers to the collection rate of post-consumer household waste. Total collection rate is slightly different due to other waste streams having other collection dynamics.

4. There are different ways of defining what share of textile volume is “available to recycling”. This paper uses the term to describe textile waste that is collected and does not have an alternative use with a higher value that is further up in the waste hierarchy (for example, resale). Of the share that is available to recycling, there may be fiber fractions that technically are not eligible for fiber-to-fiber recycling. Our base-case scenario with allocated textile waste to the different recycling technologies assumes – based on our analysis of forward-looking feedstock purity requirements by recycling technologies – that 70 percent of what is available to recycling can technically be recycled.

5. Can either be open-loop recycled products like cleaning rags, or thermo-chemical recycling to create syngas.

6. Here defined as fiber-to-fiber recycled volume divided by total gross waste. The rate reflects the estimated full potential of fiber-to-fiber recycling of 70 percent of what is available to recycling. This number excludes open-loop recycling.

Sources: Ellen MacArthur Foundation; European Commission Joint Research Centre (JRC), 2021; Eurostat Prodcom; expert interviews; Higher Institute for Environmental Protection and Research, Italy reports no. 1 and no. 2, 2021; Humana Annual Report, 2020; Intecus, Germany report, 2020; JRC Technical Report, 2021; Modare, Spain country report, 2021; Nordic Council for Ministers Baltic Countries report, 2020; Rebel, Netherlands report, 2021; ReFashion, France report, 2020; Unweltbundesmt, Austria report, 2022; Deloitte European Market Study for ETSA, 2014

To reach this scale, we estimate that capital expenditure investments in the range of €6 billion to €7 billion would be needed by 2030. The entire value chain, including textile collection, sorting, and recycling, requires investments to reach scale. Our analysis indicates that this industry could—once it has matured

and scaled—become a self-standing, profitable industry with a €1.5 billion to €2.2 billion annual profit pool by 2030. The textile recycling value chain could create a new valuable raw material that enables more apparel production in Europe, which may lead to additional value creation above what is quantified in this report.

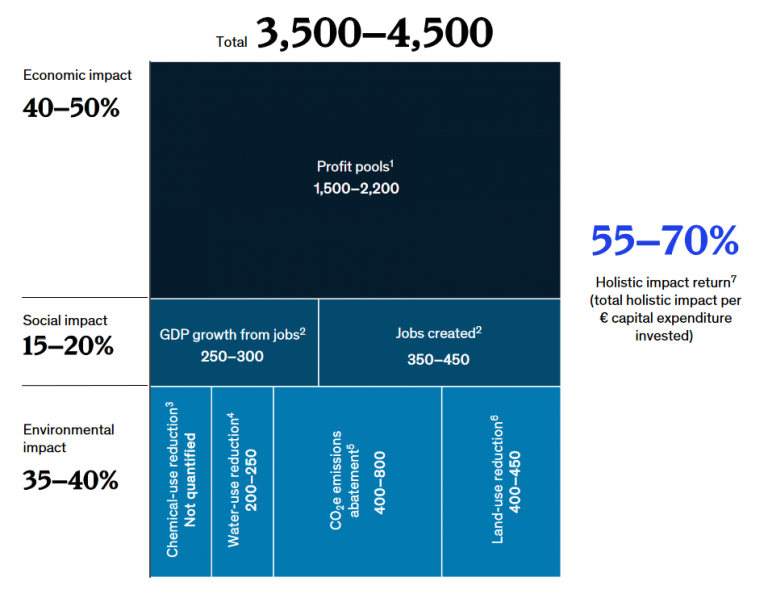

Beyond the direct economic benefits, scaling textile recycling unlocks several environmental and social benefits. For example, in our base-case scenario around 15,000 new jobs could be created and CO2 emissions could be reduced by around four million tons – equivalent to the cumulative emissions of a country the size of Iceland. By quantifying into monetary terms several other impact dimensions like the secondary effects to GDP from job creation, CO 2 e emission reduction, and water- and land-use reduction, our analysis shows that the industry could reach €3.5 billion to €4.5 billion in total annual holistic impact by 2030 – coming to an annual holistic impact return on investment of 55–70 percent (Exhibit 2).

Exhibit 2

Scaling textile recycling in EU-27 and Switzerland to the base-case scenario could yield an annual holistic impact of €3.5 billion to €4.5 billion in 2030.

Total potential annual holistic impact by type and source of impact for EU-27 and Switzerland, € million

ESTIMATE AS OF JUNE 2022

1. Based on a price that is comparable to the price of the virgin equivalent whenever virgin quality is achieved, and a price with 30% discount compared to the price of the virgin equivalent when quality degradation occurs. Operating-expenditure and capital-expenditure estimates are from McKinsey analysis. The upper range of profit assumes green premium of 25%.

2. FTE-estimates from McKinsey analysis and industry experts; average annual earnings of €26,000 assumed (Source: Eurostat, 2021); fiscal multiplier of 0.67 assumed, meaning that €1 in wages increases economic growth by 67 cents (Source: European Central Bank; International Monetary Fund).

3. The impact potential of all chemical usage improvements has not been quantified separately but could be substantial.

4. Water consumption estimate of ~600m3 water/ton fiber output, average all fibers (source: Mistra Future Fashion [summarizing various data points]); water price estimate: average of estimates in India and Bangladesh (source: “Dhaka WASA raises water price by 24.97% for households,” bdnews24.com, February 2020).

5. Mistra Future Fashion (summarizing various data points); McKinsey analysis for recycling technologies; Higg MSI; carbon cost: European Union Emissions Trading System (EU ETS).

6. ~2 hectar/ton fiber output, average all fibers (source: Stockholm Environmental Institute); land rental price estimate: ~€140/hectare, representing average of EU and low-cost country land prices (source: Eurostat and banglabuysell.com)

7. The combined holistic impact—across the dimensions calculated—as a share of the total capital-expenditure investments needed across all the value chain steps

To capture this opportunity, collaboration and innovation will be key. The identified bottlenecks preventing scale are significant and will require

several stakeholders to act boldly. Textile recycling in Europe will not reach a favorable state by 2030 unless major action is taken quickly. This report identifies five main ingredients for success.

- Critical scale. The textile recycling value chain cannot function at small scale. Critical scale across the value chain is required to provide sufficient feedstock 2 to the necessary fiber-to-fiber recycling technologies, and to allow for those recycling technologies to operate at scale. Therefore, the industry must set bold scaling targets and meet

them. - Real collaboration. Several of the main challenges ahead are best solved in a highly collaborative manner. Business leaders across the value chain, investors, and leaders of public institutions would need to come together in an unprecedented way to engage in a highly operational joint effort to overcome the barriers to scale.

- Transition funding. Although our analysis indicates that the textiles recycling industry could – once it has matured and scaled – become self-standing and profitable, transition funding will be needed in the near term. Examples of such funding include subsidies (potentially Extended Producer Responsibility [EPR] funding) and a green premium (potentially shared by brands and consumers). Public- private solutions may be needed.

- Investments. Several parts of the value chain must be built out almost from scratch, which requires significant capital expenditure. Our analysis indicates that sufficient economic value can be realized to make up for the required risk. Private investors would lead this journey by taking initiative to finance building out the value chain.

- Public sector push. Leaders of public sector institutions would have to help drive textile recycling. Measures include driving up collection rates, limiting the export of unsorted textile waste, engaging in demand stimulation, creating harmonized frameworks for increased circularity, as well as

other initiatives.

Fiber-to-fiber recycling at scale can help address Europe’s waste problem by turning waste into value. The European apparel and textile industry can start expanding the required infrastructure for collection, sorting, and closed-loop recycling today. This report establishes the opportunity at stake for textile circularity and highlights actions required to capture it. Furthermore, we hope this report can be a foundation for further research and collaboration to establish textile recycling at scale in Europe.

Read more at the full report.